The annual profits of the HDFC Bank Fy25 grew 11 percent to year to ₹ 67,347 million rupees. | Photo credit: Shaileh Andrade

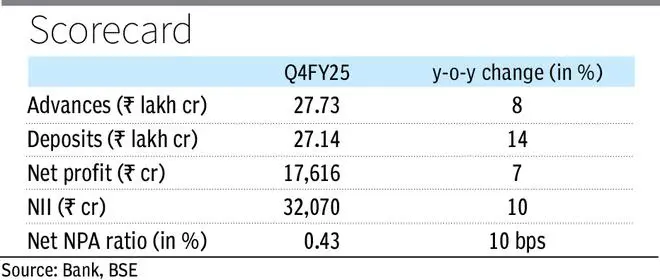

The largest lender of the private sector HDFC Bank today reported his net gain Q4Fy25 in ₹ 17,616 million rupees, 7 percent more year -on -year (interannual), led by stable growth in incoming net interests (NII) and lower provisions.The annual profits of the Bank Fy25 grew by 11 percent in the year to ₹ 67,347 million rupees.

The general advances of HDFC banks increased 8 percent in the year to ₹ 27.73 Lakh Crore in March. Meanwhile, general deposits increased by 14 percent year -on -year to ₹ 27.14 Lakh Crore. In the fiscal year26, the Bank aims to increase its in-line loan book with the growth of the industry and reduce its credit deposit ratio (CD) to the level of fusion prior to HDFC or 85-90 percent for fiscal year 2017, 97 percent in March and 104 percent a year ago. The competition for prices in corporate and mortgage loans is still high, said management. Net interest revenues (NII) grew 10 percent to year to ₹ 32,070 million rupees in the fourth quarter.

The net margin (NIM) increased slightly by 3 basic points (BP) in the fourth quarter to 3.46 percent. “You have to look at it (NIM) approximately one year or more than one period, where you will see that there is a stability on the margin, with a bias up, as we begin to reduce loans and replace it with deposits,” Sid Srinivasan Vaidyanathan, Hrinivasan Vaidyanathan,

The quality of the assets improved Dryentialy, with a gross and net ratio of net assets (GNPA, NNPA) hiring in 9 PB and 3 PB in the quarter to 1.33 percent and 0.43 percent, respectively as in the end of March.As the quality of the assets improved, the provisions fell 76 percent with the year at RS 3,190 million rupees in the fourth quarter.

According to the bank management, the lender is waiting for the approach of the Bag Board and Exchange of India for listing its HDB financial services of non -bank arm HDB. By regulatory guidelines, the NBFC arm should appear in September 2025.

More like this

Posted on April 19, 2025