The Acorns savings and investment startup has acquired Earlybird, an investment gift platform for families, the company told TechCrunch exclusively. The financial terms of the agreement were not revealed.

As part of the acquisition, Earlybird will close and all customer accounts will be officially closed on June 23. Customer funds will be returned to the bank account connected to your account.

Founded in 2019, Earlybird launched a product that combined financial investments with the community. The application allowed families and friends to give investments to children while preserving memories through a digital time capsule. The investments would become the child once they turned 18, and could use funds for things such as paying the university, paying an initial payment of a house or carrying out their first business.

“When we find Earlybird, we imagine creating a platform that would transform how families leave pursuing legacies for their children,” said the CEO and co -founder of Earlybird, Jordan Wexler, in a statement. “The opportunity to join acorns not only reaffirms our vision, but also expands our impact to millions of families who also care about building their children’s financial future.”

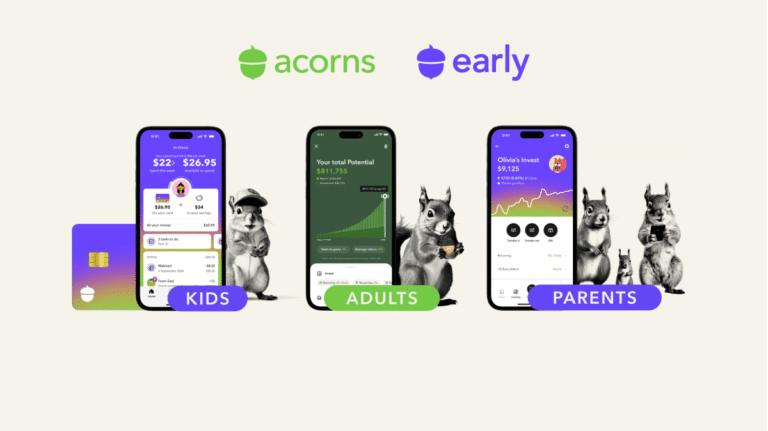

Wexler and co -founder Caleb Frankel will join the Agorns team to help build acorns early, the Startup Smart Money application for children. Acorns sacrifices early a debit card designed for children and adolescents to help them develop financial education and manage their money. The Company launched Aquarns after its acquisition of Goenry, a startup focused on providing money and financial education services to young people from 6 to 18 years.

Agorns believes that by bringing Wexler and Frankel, the company will be able to take advantage of its experience and passion for space to improve acorns early.

“Our vision is to build a financial welfare system for the whole family, creating a compound growth at each stage of life,” said the CEO of Acorns, Noah Kerner, in an email to Techcrunch. “The experiences and ideas shared between our two teams will allow us to offer this vision faster and better, so we create maximum value for everyday American families.”

The existing clients of Earlybird will be sacrificed a free subscription of one year to “Bellots Gold”, a plan that sacrifices access to all acorns products, including early acorns. Customers will receive an email detailing the registration process.

Acorns points out that Earlybird users will not be able to transfer their early funds to the acorns early. If users want to continue their investment trip with acorns, they need to withdraw their Earlybird funds and open a new account with acorns.

The company plans to integrate the Earlybird digital time capsule function in the Tecns Early application on a later date. In Earlybird, the function allowed users to build time capsules recording videos in memorable moments of their lives. For example, if a mother received a promotion and would like to give a unique investment to her child, you could record a video that talks to your child to commemorate and remember the moment.

The acquisition occurs when Acorns has doubled its customers in Agorns Gold, its subscription plan of $ 12 per month, during the past year.

“Our Gold Plan will be the place to offer financial well -being for the whole family: products for parents, children and all connective fabric between family unit,” Kerner said. “This will be the place where the whole family can administer their money as they cultivate intelligent money habits together.”

Agorns raised $ 300 million in March 2022 and was valued at $ 2 billion at that time. The company did not provide an updated assessment.