Individual coverage health reimbursement arrangements, without colloquism known as Ichras, have entered the spirit of spirits. ICHRA allow employers to provide employees with a fixed amount of money before taxes to buy individual health coverage and pay health expenses. Recent articles have called VC’s interest in space with some medical care players, Ichras like Bitcoin, given the buzz level. The hum is obtained well since the number of employees offered by Ichras continues to grow. However, the winds against, including competition, uncertainty of the individual coverage market and complexity, can hinder Ichra’s opportunity.

General description of Ichra

Before Ichras, the qualified health reimbursement agreement of the small employer (Qsehra) created under the OBAMA administration allowed employers for less 50 full -time employees to provide money before taxes for employees for healing expenses. Trump’s first administration created the ICHRA with Ichras that became AV by the public in 2020. The ICHRA is a defined contribution or a fixed payment to employees, which limits the exposure of the employer to the increase in medical costs. Employers have faced growing costs since the Kaiser Family Foundation states that the average premium for the unique and familiar coverage for employer’s health insurance has grown by 22% since 2018.

Estimates suggest that approximately 500k employees participate in an Ichra at the end of 2024. The adoption of ICHRA among employers grew almost 30% from 2023 to 2024 over time largely among employers. In general, the number of US employers offered by Ichra / Qsehra have almost tripled since 2020. Oscar Health Projects that the total size of the segment of small and medium enterprises (SMB) is 75 million lives, which means only one today. As such, there is the potential that Ichra expands to a large population.

Interestingly, the growth of Ichra diverges the growth of another definite contribution of the employer: 401 (K). At the end of 1982, almost half or great US employers sacrificed a 401 (K). 401 (K) expanded from large employers to small employers. In contrast, the ICHRA is a history of growth of small businesses that tries to advance in the market. Most employers participating in an ICHRA are small employers with less than 50 employees. It is an open question if the adoption of Ichra will continue to expand to employers with more than 50 employees, but the adoption of ICHRA among these employers grew by 84% between 2023 and 2024.

Ichra market participants

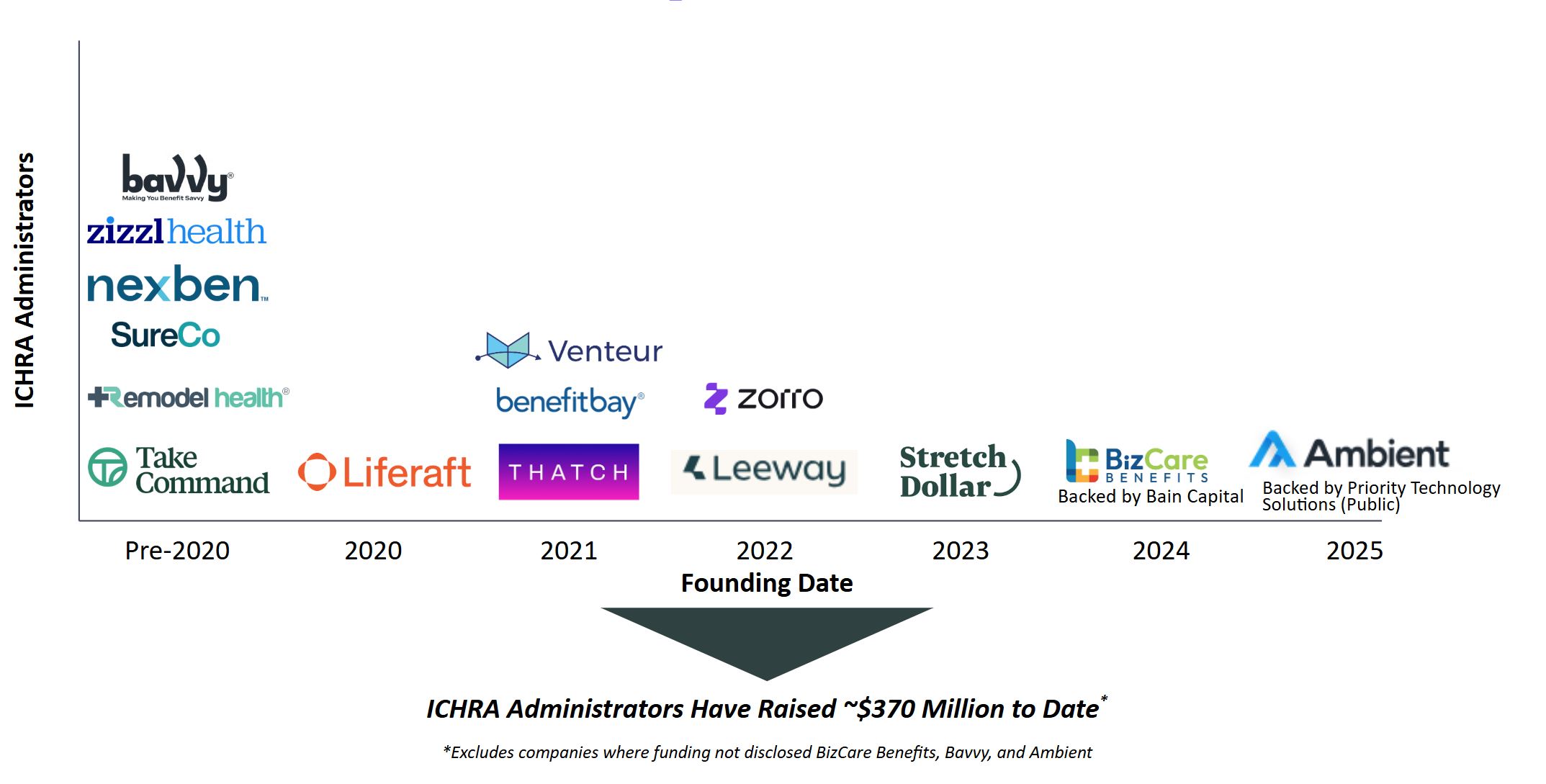

Directing and capitalizing the growth of the Ichra market are the administrators of Ichra. These companies like Take Command, Thatch, etc. They support employers in the design of the ICHRA program, the registration of employees and the continuous management of the ICHRA. ICHRA administrators obtain income through platform rates and insurance companies commissions. The administrator platform rates are charged to employers in an employee per employee per month (PEPM) basic and are generally in the range of $ 20 to $ 40 PEPM. In addition, some administrators have insurance agencies that can generate commissions from insurance companies when an Ichra employee selects insurance through their platform.

ICHRA administrators per year of Foundation

Image created by the author, source of information, pitchbook

Beyond the administrators of Ichra, financial care companies and medical care payers are entering Ichra space. Fintech companies, such as Echo and Lynx, build financial infrastructure so that ICHRA administrators deliver payments for medical care and medical care expenses in employee being. Payers such as Craftster Health (a Centennene company) and Oscar have recently looked for Ichra as a growth driver. Art Cet Health hired a president to supervise his operations in Ichra, and Art Cet Health has reached channel associations with Ichra administrators (here, here). Oscar has called his focus on Ichra in a recent presentation of investors, and Oscar has participated directly in the collection of funds from the ICHRA administrator (see the collection of stretchdollar seeds funds).

Challenges to Ichra in the future

Ichras defends the stability of the individual coverage health insurance market. Currently, The Individual Coverage Market is Stable, But Subsidies for here Premiums are antipated to expire at the end of 2025. If the expiration of subsidies the individuals resort Them to leave the aca market, There Make -Making as There Ichra Plans and Thereba’s Plans and Thereba -ichka -ichka -ichka -ICHKA -ICHKA -ICHKA PLANS AND THERBA -ICHKA -ICHKA -ICHKA -ICHKA -ICHKA’S MAKE ICHKA -ICHKA -ICHKA -ICHKA -ICHKA is doing ichka -Hakka -Hakka is doing ichka -Hichka is causing Ichkaa Ichka to make ichkaa ichka -plans and the bases make the manufacture and manufacture of (plans) less attractive.

Beyond the dynamics of the ACA market, the Ichra administrators market is competitive with several new participants in recent years. Administrators differentiate in their market strategy, service level and Fintech capabilities. However, Ichra administrators are performing similar functions for similar companies. Each administrator is trying to capture as many employer clients as possible in great competition that produces a hard competition among players.

In addition, Ichra administrators face the competence of Peos and Corridors. Peos, such as Justworks, manage the administration of benefits for small businesses, and Peo often can connect small businesses directly with a group plan. The runners compete against the ICHRA administrators who sell small businesses health coverage. Corridors can face lower commissions that involve a client in an Ichra instead of a group plan entangles Ichra’s growth through the runner channel. Anecdotally, runners can only reach an ichra if an account was going to “roll” or leave them as a client. Despite these challenges, some Ichra administrators are working closely with peos and runners to act as sales channels for employers who could be interested in looking for an Ichra.

Where is Ichra

The increase in the group group the premiums, the stable individual markets and the desire for individual choice suggests that Ichras will continue to be an attractive option for employers. However, players in the Ichra market can be different in the future. We could foresee the large number of ICHRA administrators collapse in a handful of great dominant players given the limited amount of differentiation between administrators. This would follow a trend similar to what was seen in the Peo market, where 5 peo of a total of ~ 500 peos represent ~ 40% of employees participating in Peos. We anticipate smaller ICHRA administrators that differentiate in their channel associations (EC, broker, PEO relationships), capacities (EC, attention navigation), relations with the payer and specialization of the employer (EC, focusing one / a few types of employers).

Beyond the consolidation of the ICHRA administrator, we propose the hypothesis that there may be consolidation between the administrators of Ichra and Las Peos. Under this scenario, an Ichra administrator obtains access to a group of existing clients to sell, reducing acquisition costs and potentilly expanding its scope. While payers are active in the Ichra space, we do not believe that an Ichra administrator appreciates a paying acquisition because it would limit the number of insurance companies that an Ichra administrator could offer to employers. However, a company like Craftster Health or Oscar can see an acquisition of an ICHRA administrator more favorably as a means to expand their risk group and enrich their risk group with younger workers, since 35% of ICHRA employees are less than 34 years old.

In general, we anticipate continuous growth in the number of employees who offered an Ichra. However, given the strong competitive dynamic between the administrators of Ichra and the potential individual market risk with the expiration of the ACA subsidy, we are moving cautiously when we look at companies. The new participants must have a strong competitive differentiation in relation to existing competitors to consider possible investment candidates.

Photo: Rudall30, Getty Images

The author thanks the members of the Oca Ventures health team, Michelle Cao, Bob Saunders and Sarah Manasevit for their orientation and support in this article.

Ohn Symej is currently an internal MBA in Oca Ventures in the health team. Oca Ventures is a VC with headquarters in Chicago that invests in Technology and Health Companies of the series A. The OCA Medical Care Team invests in companies throughout the diagnostic, digital health and IT TI spectrum. Before Oca, John co -founded and led a digital oncology health company backed by VC called Primum. He is currently pursuing his MBA at the Northwestern Kellogg School of Management and is based in Evanston, Il.

This publication appears through Medical influencers program. Anyone can publish their perspective on business and innovation in medical care in Medcity News through influential people of Medcy. Click here to find out how.