The first reduction in Australia’s interest rate in four years, in the midst of continuous growth in properties prices, has caused a renewed talk of “mortgage wars”, but housing houses that seek a better treatment could increase some factors.

According to the latest reports of PEXA Properties and Mortgages, refinancing volumes at 12.5 percent in March, compared to the figures of the previous year, a finding attributed to the waterfalls of the loans of housing buyers for housing buyers for housing buyers for housing buyers for housing buyers for housing buyers for housing buyers for housing buyers.

On the property, the five continental statements of Australia saw a total of 156,573 settlements with a total value of $ 158.5b in the quarter, an increase of 1.2 percent in volume and an increase of 5.3 percent in the value of the same quarter last year.

If this, $ 140.7b spent on residential properties, an increase of 6.4 percent in the previous year.

Compared to five years ago, this amount represents an increase of 56.1 percent in residential properties settlements since March 2020.

The demand for properties in Queensland, Western Australia and Australia del Sur continued to be strong.

QLD registered the largest number of settlements (43,530), but Victoria and SA registered the greatest growth in sales of residential properties, 4.1 percent and 4.3 percent respectively of the same period last year.

Related

Mortgage hooks that could cost you a lot

Refinancancia loans without compensation can lose money from borrowers

Adjustment that could unlock houses for 400,000 Australians

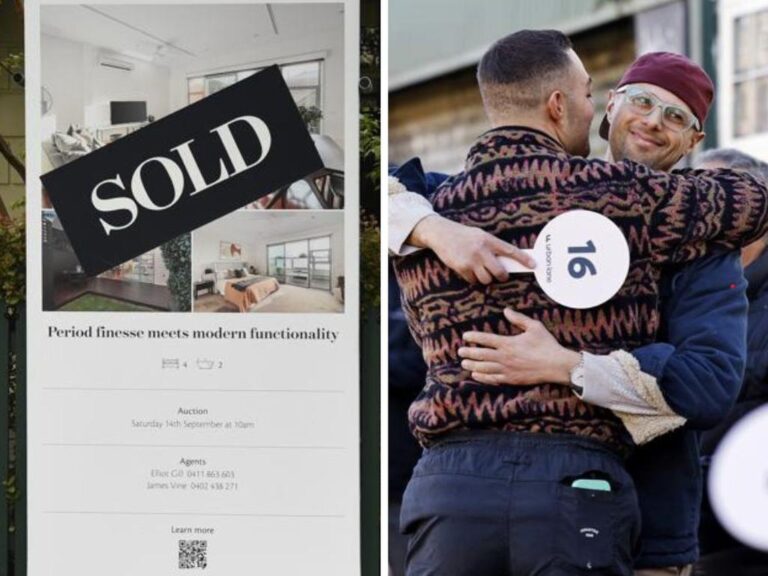

The borrowers get more purchase power with rates cuts. Image: Sam Ruttyn

NSW and WA stayed behind the other states, both grew by less than 1 percent.

However, QLD, WA and SA registered a growth of 12 to 15 percent in the added value spent in property compared to the same quarter of last year.

The prices of residential properties continued to rise in the quarter, partly in QLD, where the average prices of residential housing have increased far beyond prices in their oriental counterparts.

In Gran Brisbane, prices increased by 12.3 percent in the previous year and by 13.6 percent in regional QLD.

In terms of higher suburbs for residential settlements, in NSW, there was a mixture of external growth suburbs in the great Sydney strip, suburbs of the city center and regional cities Port Macquarie, Dubbo and Orange.

In Vic, the list includes growth suburbs in the west, north and southeast of Melbourne; In QLD, the Costa Dorada and the Costa del Sol; While in WA, Greater Perth is booming.

In the commercial property sector, Vic and QLD performed strongly with higher liquidation volumes compared to the previous year, while in NSW the sector seemed slow, with volumes of commercial settlements throughout the state. However, in value, NSW solved the most in commercial properties ($ 7.7b), followed by Vic ($ 5.6b) and QLD ($ 4.5b).

More news

Huge Boomer movement impacting all Australia

‘Kiss your goodbye to pension’: Radical Plan to eliminate the boomers

Interest rates have been reduced by RBA since 2022.

In mortgage trends, the number of home loans issued increased by 4.4 percent to a total of 118,320 and a total value of $ 80.2b. Of these, $ 73.5b were for residential properties that represent an increase or 8.2 percent in the quarter of March in the previous year.

Significantly, the refinancing activity that had decelerated in 2024, recovered strongly the quarter of March, with 91,786 refinancing established, an increase of 12.5 percent compared to the previous year.

Pexa Group’s chief economist Julie Toth said the reports show that the decision of the February Reserve Bank to reduce the official cash rates was already demonstrating a tangible impact on the Australian mortgage market.

“Growth in refinancing activity has been driven by the recent interest rate rate, which is a greater debt capacity for prospective buyers, and turned out that lenders introduce incentives such as reduced loans from fixed rates and cash incentives for housing buyers.

“We continue to see the growth of the price of housing in the continental states, and a growing demand for properties in QLD, WA and SA. This consolidates a trend of interest from the buyer that moves away from NSW and Vic to the smallest capital cities, and the southeast QLDD.

“This greater popularity in QLD is also reaching a cost for the first housing buyers with an increase in housing prices and the proportion of properties that are sold less than $ 800,000 now in a strong decline.”