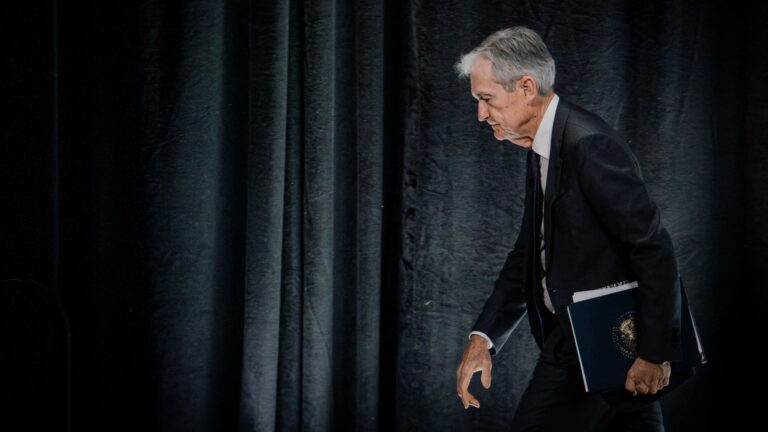

Jerome Powell, president of the United States Federal Reserve, duration, an economic club or Chicago event in Chicago, Illinois, USA, on Wednesday, April 16, 2025.

Jamie Kelter Davis | Bloomberg | Getty images

President Donald Trump increased on Monday his pressure campaign on the president of the Federal Reserve, Jerome Powell, called him a “great loser” and warned that the economy of the United States could reduce the speed unless interest rates are taken immediately.

“Previous cuts” are requested in interest rates for many, “Trump wrote in Truth Social.

Trump said there is currently no “virtuous inflation” in the United States, and that energy costs and “most other” things “are in decline.

“With these trend costs so well descending, just what I predicted that they would do, there can hardly be inflation, but there may be a deceleration of the Insulas Mr. Also, a large loser, reduces interest rates, now,” Trump. “

Trump’s last save against Powell, whom his first administration named duration, occurred when the president and his team are studying whether they can legally fire the Central Bank leader before his mandate expires in May 2026.

Powell has struggled that the president cannot eliminate him under the law.

Any Trump attempt to shoot Powell would probably trigger a strong sale in the US Variable Income Markets. UU., A CNBC, Evercore Isi Vice President Krishna Guha, on Monday to CNBC.

“If you start asking questions about the independence of the Federal Reserve, the bar is increasing so that the Federal Reserve cut it. If you really tried to eliminate the president of the Federal Reserve, I think he would like a severe reaction in the market yields,” “” “Chamas Box.”

“I can’t believe that is what the administration is trying to achieve,” Guha said.

The stock market, which already wobbles due to the uncertainty and other concerns voting from the Trump administration tariff plans, sank more on Monday morning. The Dow Jones industrial average fell 750 points, a fall of almost 2%, within the first hour of negotiation, while Nasdaq fell 2.6%.

The US dollar, meanwhile, slid at its lowest level since 2022. Rotation in global markets has sent investors who attend the safe dropout assets of the Golden drop, which reached a high record price on Monday, while the reference point produces.

Trump’s last attacks against Powell followed the suggestion of the Central Bank leader last week that the president’s commercial warfare limits growth and could feed inflation.

It is likely that the rates “will take us more from our goals … probably for this year’s balance,” Powell said in the Chicago Economic Club.

Powell also not suggested that interest rate cuts were on the horizon.

“At the moment, we are well positioned to expect greater clarity before consulting any adjustment to our policy position,” he said.

– Alex Harring of CNBC contributed to this report.

Correction: Krishna Guha is vice president or Evercore Isi. An earlier version lost its title.